Gasoline Price Manipulation

Written April 2

During the political season of republican primaries and caucuses, what is becoming a factor in the race for the presidency of the United States, has been the price of gasoline. Republicans have made it a unified scripted political statement that the current energy policies of this country are the primary reason for the rise in gas prices at the pump. As tax breaks are hurting exploration and the continued closed status of federal lands for drilling increases our dependence for foreign oil. So what is the truth or political posturing that comes forth from mouths Romney, Gingrich and Santorum?

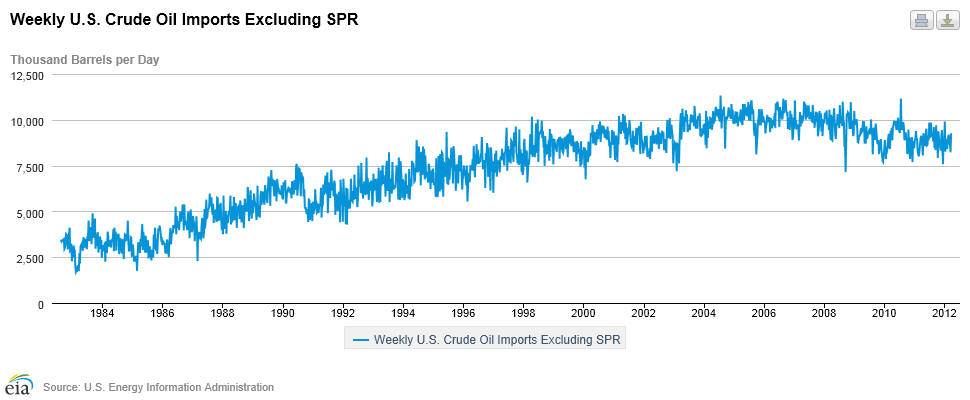

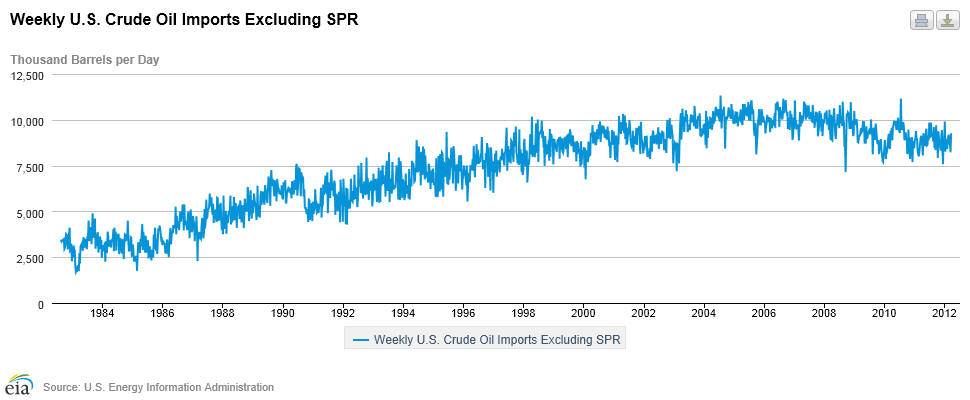

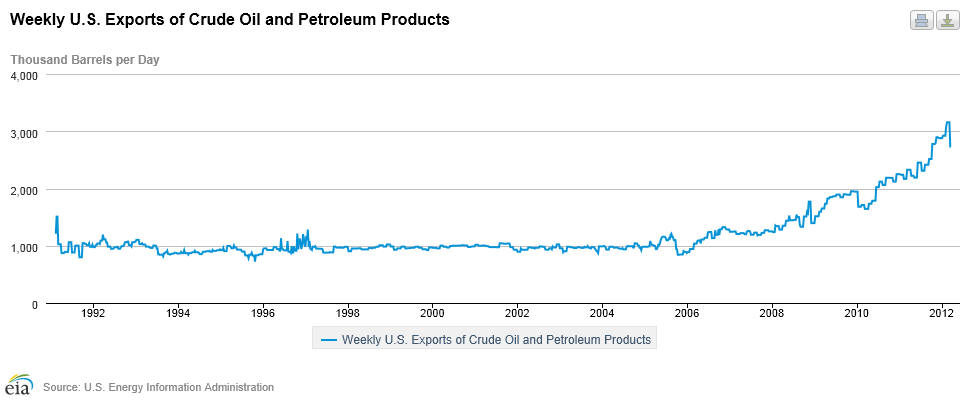

What they don't tell you that the oil companies base the price of a barrel of oil on the spot market price, yet most of their oil purchases are long term contracts with price below the spot market. Thus are far less to be rattled by spikes created by political unrest and temporary shortages, yet all companies take advantage of turmoil to increase profits. Here in the United States we import less oil than the years under Bush (Chart A below), but the biggest factor affecting the price of gas is that we export 100s of thousands of barrels a day just to Mexico alone not to mention the rest of the world (Chart B below). Total oil exports by the United States of petroleum products to the world is just under 3,000,000 barrels per day in 2012 (Chart C below).

The Oil Companies have reduced refining capacity to near 83% when in the nineties they averaged above 90%. This a common tactic used on the west coast to boost prices by squeezing supplies to the pump through decreased refining capacity. With crude oil stocks in the US rising and gasoline demand down from the year before (Chart D below), the supply and demand equation is not applying here. We see that excess supplies that could be used to lower prices here is sold the highest bidder overseas, thus pump prices remain high here in the states. What does this say about oil companies and new supplies, in a world market? New production here would generate a revenue stream of profits from overseas while the US consumer would see gasoline that could be used to lower pump prices sent where the best price could be fetched. This is a fact. The only speculation republicans can state, is that their war mongering talk involving Iran has added to your misery at the pump as future prices are exploited with the threat of bombing and the blocking of the straits. Just know this, if Israel does attack, few Americans will be able to afford to drive. The fear of a weapon being developed that has no delivery system and would be the size of a small car as a prototype will not be used to destabilize the middle east. Where escalations which Israel will have no control over could involve Russia and China. A war far worse than the one they are trying to prevent with a preemptive strike.

It is a fact that crude inventories and gasoline supplies are up.

It is a fact that US exports 100s of thousands of barrels of refined gasoline a day to the world.

It is a fact that speculation due to tensions in Iran and greed is driving up spot oil prices.

It is a fact we import less oil than in the Bush years.

It is a fact that Americans are using less gasoline due to the recession and prices.

It is a fact refining capacity has been cut to tighten supplies and maintain prices.

These are the facts affecting the gasoline markets in the United States, not a policy of a lack of more drilling.

What oil companies are doing is capping finds until the price is right. This is a fact.

Removing excess gasoline from the American markets and selling overseas to the highest bidder. This is a fact.

Now which of facts the above is an Obama policy?

The same old gasoline facts don't lie in an election year, but some politicians do.

It is time for the truth.

Question for the Republicans: Just where is all that Halliburton oil money from Iraq, you promised would pay for the war (50 billion+/year)?

Change is needed in the Oil Industry, but promoting a long term plan to provide a short term solution is not common sense. Republicans seem to be short on that trait. What we need is a leader that will reign in the corruption and speculation on the oil futures markets through regulations that controls future contracts for what they were meant to do. Lock in a commodity price for a period of time to protect against market swings, not a source of trading revenues for financial firms at the expense of the American consumer. Since all three of you candidates read from the same prepared script, I see little leadership here. Nor will they choose to bite the hand that feeds them. So I will leave to Obama to accomplish this, since presently there is no one better to accomplish this despite the recommended baggage of appointees as a compromise to established democrats.

An immediate lowering of the price of gasoline will take place if regulation of futures contracts is considered seriously, thus helping all in America. Do we as nation, have the conviction to come together behind this cause or will it be Republicans vs. Democrats and the American voter loses again to the most profitable corporations in the world. When you choose a leader for the free world in November, remember where all stood and did they work for your best interest, instead of the media hype and advertizing pounding television screen. Votes are earned by actions, not paid opinions delivered in mass through the media as promises built of distortions of what was once the truth. This time to choose what is best for America, instead being told what you want.

All Rights Reserved: © Copyright 2012

Chart A

Chart B

Chart C

Chart D

Current US Crude Oil Supplies

Inventories are near the top of the five year range

Stats of gasoline demand, production, stocks, prices

Gasoline Production and Imports (Million Barrels per Day)

|

||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Four-Week Averages | Year Ago | Week Ending | Year Ago | |||||||||||

| 03/09/12 | 03/16/12 | 03/23/12 | 03/25/11 | 03/09/12 | 03/16/12 | 03/23/12 | 03/25/11 | |||||||

| U.S. | 8.809 | 8.756 | 8.732 | 8.873 | 8.821 | 8.762 | 8.756 | 8.696 | ||||||

| East Coast (PADD 1) | 2.772 | 2.782 | 2.786 | 2.836 | 2.828 | 2.769 | 2.805 | 2.764 | ||||||

| Midwest (PADD 2) | 2.145 | 2.110 | 2.093 | 2.127 | 2.114 | 2.050 | 2.082 | 2.100 | ||||||

| Gulf Coast (PADD 3) | 1.942 | 1.969 | 1.976 | 2.152 | 1.953 | 2.007 | 1.983 | 2.202 | ||||||

| Rocky Mountain (PADD 4) | 0.294 | 0.288 | 0.289 | 0.288 | 0.290 | 0.277 | 0.301 | 0.268 | ||||||

| West Coast (PADD 5) | 1.539 | 1.528 | 1.503 | 1.536 | 1.552 | 1.474 | 1.489 | 1.487 | ||||||

|

Gasoline Stocks (Million Barrels) and Days of Supply

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Regular Gasoline Retail Prices (Dollars per Gallon)

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||